Over the last few years, the U.S. market for natural gas liquids (NGLs) has undergone significant changes that have introduced complexity and compressed margins for NGL midstream companies. Let’s discuss four of the most significant changes in the market and how NGL midstream companies can maintain healthy margins in this landscape.

1. More shale production has caused a resurgence in domestic petrochemical production. The oversupply of NGLs has driven prices downward, making it more economical to build petrochemical factories in the U.S. rather than overseas.Many consider Pennsylvania to be the next hub of petrochemical activity in the U.S. A recent study of the area concluded that the Marcellus and Utica shale plays could spark “a ‘manufacturing renaissance’ that includes more ethane cracking plants and petrochemical and plastics facilities.” Shell Chemical Appalachia is currently constructing an ethane cracker in western Pennsylvania and other companies are expected to follow suit in the near future.

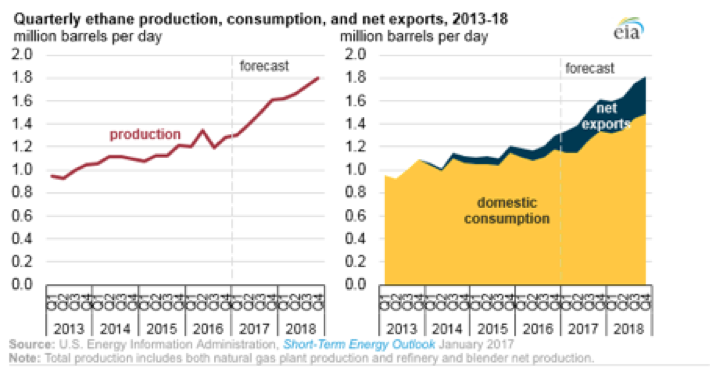

2. High shale supply also means a high demand for export capacity. The U.S. produces more NGLs and has exceeded domestic consumption; therefore, the U.S. can export more NGLs overseas. The U.S. Energy Information Administration (EIA) estimates that by 2018 U.S. ethane production will reach 1.7 million b/d, which will also drive up exports.

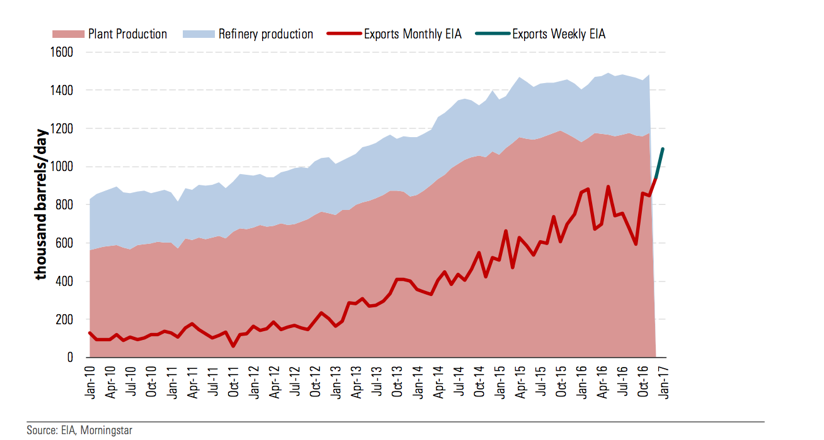

Additionally, the EIA reports that the U.S. is now a net exporter of propane rather than a net importer. Except for a steadily dwindling supply of propane from Canada, the U.S. is largely independent of propane imports. That’s why investment in export facilities has increased significantly, particularly in the Gulf Coast and along the U.S. East Coast. The chart below shows the rapid export growth from 2015 into 2017.

New NGL infrastructure and additional optionality in storage and transportation capacity have altered product flow, increased logistical and scheduling complexity, and made operational decision-making more challenging. According to RBN Energy’s Pending List of NGL Pipeline projects, nine major NGL pipelines are now operational since 2014 and an additional seven pipeline projects will be completed by Q2 2019. The new pipelines, coupled with increased NGL petrochemical demand and growing export volumes, have fundamentally changed the historical flows in NGLs in North America, making it operationally very difficult to make the right logistics decisions.

Weather fluctuations have caused record-warm temperatures during the last few winters, which has hurt the NGL industry. In 2017, the Northeastern U.S., which typically experiences colder winters, instead enjoyed winter temperatures about 30 degrees warmer than normal—as high as the 70s! The effect has been a reduced need for propane as a heating source, lower propane sales, and losses for NGL wholesalers. This market factor has had the single biggest impact on margins.

So how can midstream companies grow revenue in these conditions? The answer lies with better integrated planning and scheduling.

Lock in purchases and sales in a more balanced way. No one wants to be in a situation in which they’ve committed to 1 million barrels but have sold only 200,000 barrels. Take a more conservative view—reduce risk exposure for buys that you have committed to but for which you don’t yet have a committed sale. Wholesalers should execute more short-term supply and sale agreements to satisfy retailers’ spot demand and avoid assuming too much risk.

Get more intimate with customers. Improve visibility into retail needs so that you can better forecast demand.

Hold your marketers accountable for enhancing the transparency of their demand forecasts and enable them to communicate any changes to their forecasts quickly and efficiently. This information should be easily captured and surfaced across your organization so you can operate in an agile manner as market conditions shift.

Better leverage existing assets. Ensure that you’re not overextended on storage capacity. Examine how you can increase storage capacity incrementally throughout the year. Perhaps you can leverage railcars as storage at the right location.

Run more scenario analysis—otherwise known as contingency planning—for diverse conditions, including average, warm, or cold winters. You should have a sophisticated playbook and potential exit strategies for any plausible scenario. The more you plan, the better you can react if that situation occurs, the more confident you are, and the more you can insulate margins from negative impact—and even maximize profits.

To use last winter’s warm temperatures as an example, many wholesalers waited too long to unload their supply. If they had reacted to this adverse market condition earlier, they could have mitigated their losses. Going forward, wholesalers should have greater optionality at the locations where they expect demand to be the highest at a certain time, such as the Northeastern U.S. in winter.

Despite its dynamic nature, the one constant in the NGL market is that it always offers opportunities despite challenges. To learn more about capSpire’s margin-widening solutions and methodologies for companies that produce, transport, and sell NGLs, please visit http://www.capspire.com/capspire-optimization-platform/supply-chain-optimization-ngls/ or email info@capspire.com.About capSpire

capSpire provides the unique combination of industry knowledge and business expertise required to deliver impactful business solutions. Trusted by some of the world’s leading companies, capSpire’s team of industry experts and senior advisors empowers its clients with the business strategies and solutions required to effectively streamline business processes and attain maximum value from their supporting IT infrastructure. For more information, please visit www.capspire.com.