Although new production was the major cause of the oversupply of crude, refinery shutdowns in March also added fuel to the fire by increasing spot volume to the Midland market.

There are many regional refineries that source crude directly from the Permian Basin:- Delek’s 73,000-bpd Big Spring refinery, which is located 30 miles east of Midland

- Andeavor (formerly Tesoro and soon to be Marathon) operates the 135,000-bpd El Paso refinery and 25,000-bpd Gallup refinery, which are both connected by pipeline to the Wink hub in the Permian

- Phillips 66 operates the 150,000-bpd Borger refinery, which gathers crude on its proprietary pipeline from Odessa to Borger, in the Texas Panhandle

- Valero’s 200,000-bpd McKee refinery in the Texas Panhandle has various crude sourcing options, with a large proportion coming via third-party pipeline from Midland

- Hollyfrontier operates the 100,000-bpd Navajo refinery in Southeast New Mexico, which is also primarily fed by Permian crude

When these refineries shut down for planned or unplanned maintenance, a portion of their daily crude consumption usually ends up in the Midland hub, where it adds to other spot supply from smaller producers that don’t have their own pipeline capacity to Cushing or the Gulf Coast. This additional supply puts downward pressure on the Mid-Cush differential, which has dominated the headlines in recent times.

Refinery turnarounds affect prices on a macro level. But what actually happens within the crude supply and logistics departments of these independent refinery operators?

For most operations, the refinery sets monthly crude slate and volume targets. It is the responsibility of traders, supply managers, and logistics groups to source the required volume and quality, and transport it to the refinery. Crude supply comes from two major sources:

purchased directly from the lease (lease crude) or purchased on bulk contracts or spot trades (bulk) from hubs such as Midland and Cushing. During turnarounds, bulk contracts can be structured so that refiners can market stranded volume to another party, or they don’t buy it in the first place. However, lease crude, which is usually managed from the wellhead to the refinery gate by the refinery’s supply and logistics group, requires a more hands-on approach.

Refiners are particularly interested in lease crude supply because buying directly from the wellhead enables them to reduce risk in their supply chains and lower costs. Most lease crude purchase contracts commit producers and purchasers for only 30 days. However, relationships often last for many years. In an ideal world, refiners would cancel their lease crude contracts while the refinery is down and restore them when the refinery comes online again. However, producers would find alternative buyers in the interim and the refiner would be left high and dry when operations resume. As such, first purchasers tend to redirect crude and store additional volume to maintain their lease portfolio.

Lease crude is transported from the wellhead to a major pipeline (mainline) by gathering lines or it is hauled by truck. Gathering line-connected leases are connected a mainline that runs from the producing region to the refinery or are interconnected to a trading hub. To deal with these leases during a turnaround, refiners reverse the flow of the mainline and send the associated production to the next best location. Dual-connected leases are shipped on alternative pipelines. Because the leases are only connected to one or two injection points, supply and logistics groups have limited options. However, truck-hauled leases are not limited to one or two pipeline injection points and as a result, first purchasers have more options to consider.

Optimization technology can help refiners better manage lease crude supply during shutdowns and turnarounds.

In February and March, a large independent refiner performed a lengthy turnaround of its refinery. As a result, it had 40,000 bpd across 2,000 truck-hauled leases to redirect from its mainline to alternative pipeline injection points (stations) in the Permian Basin. Previously, the refiner sent each lease to the nearest alternative station. However, this year the refiner deployed capSpire’s Lease Crude Optimization (LCO) system to systematically redirect each lease to its optimal station given turnaround constraints.

capSpire developed the LCO system specifically for the lease crude business to enable first purchasers to model every station in their operating regions, with geocoded locations and volume, gravity, and sulfur constraints. Crude delivered into each station is associated with a price that is calculated as a netback from the destination market (including pipeline tariff, unloading fees, and market benchmarks). Stations are linked to a pipeline, which can be constrained to a certain volume during a turnaround.

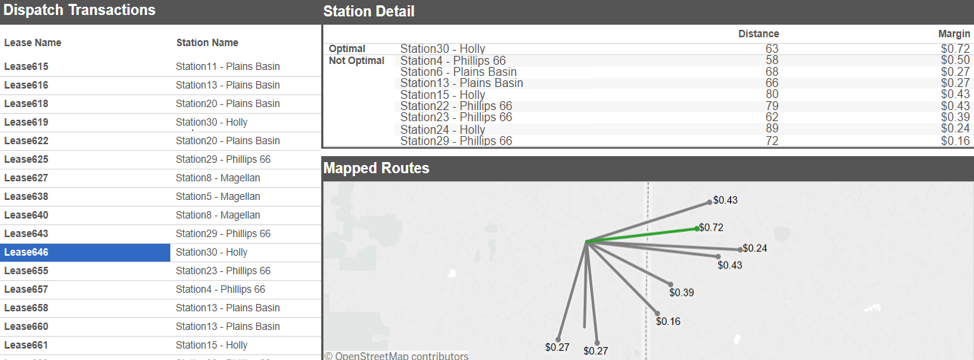

In this case, the refiner modeled the turnaround by reducing pipeline capacity and closing certain stations. Then it ran the Nominations Planning Module, which assesses the many thousands of lease-station combinations and then calculates distances, transport costs, and profit margin. The station that maximizes the overall profit is identified as the optimal station.

The image above is one of the output dashboards of the Nominations Planning Module. It illustrates that Lease 646 has nine stations in range, and has identified Station 30 as the optimal station with a margin of $0.72 per bbl, even though it is not the closest station. The LCO system conducts this analysis for all 2,000 leases in a matter of minutes, giving the supply and logistics group the truck-dispatch plan and station and pipeline nominations at the click of a button.

For more information about capSpire’s lease crude system, please contact info@capspire.com.About capSpire

capSpire, a global consulting and solutions company with a focus on energy and commodities, provides the unique combination of industry knowledge and business expertise required to deliver impactful business strategies and solutions. Trusted by some of the world’s leading companies, capSpire’s team of industry experts and senior advisors enables clients to effectively streamline business processes and attain maximum value from their supporting IT infrastructure. For more information, please visit www.capspire.com.